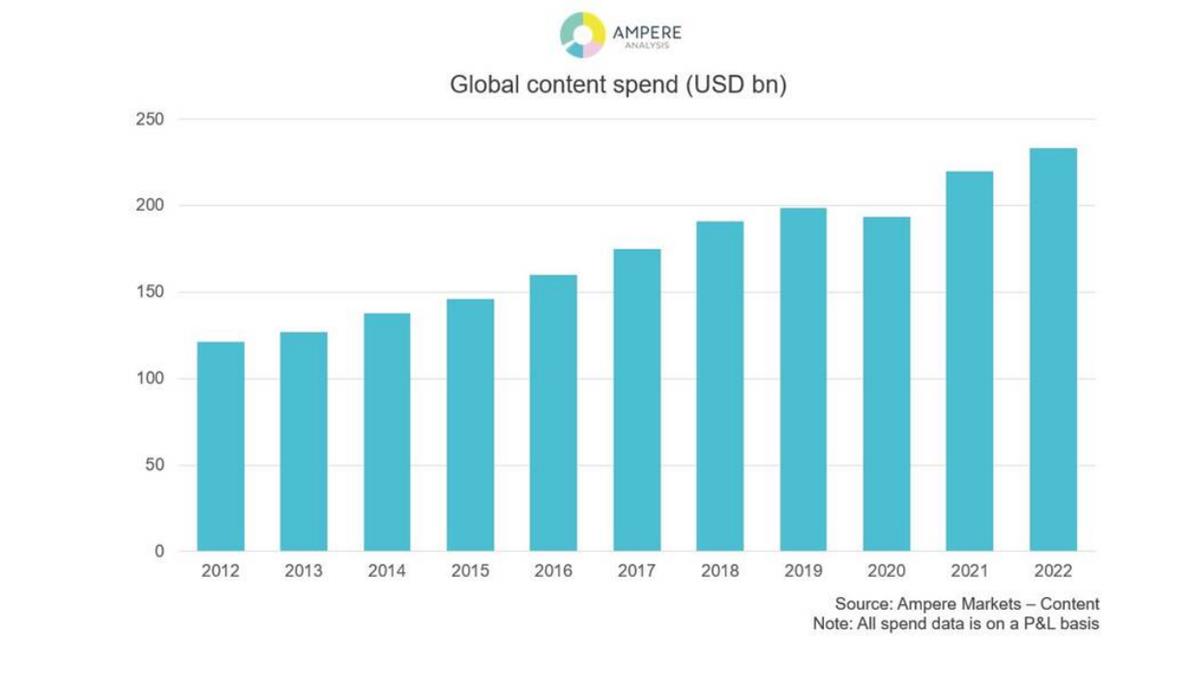

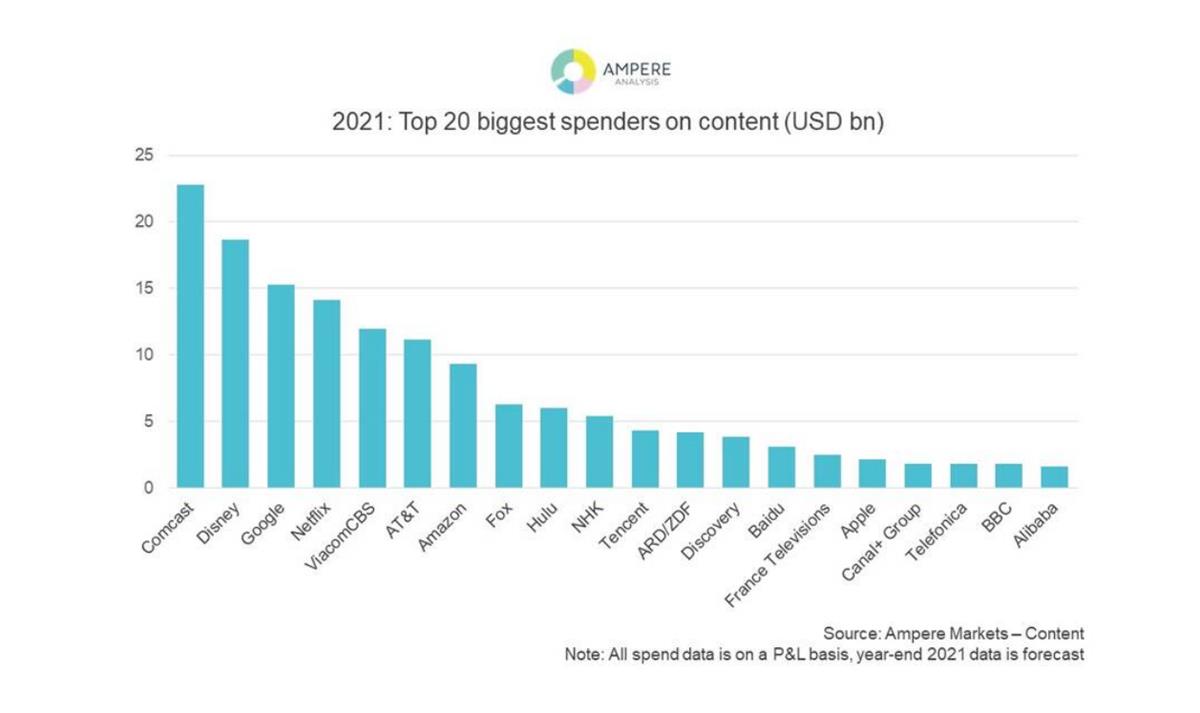

Streaming investments led by Comcast, Disney and Netflix saw the global spend on content reach $220 billion in 2021 with the pot set to exceed $230 billion in 2022, according to a new report from Ampere Analysis.

In the report, Ampere notes that investments increased by 14% compared to 2020, representing an increase of more than $20 billion.

CHARTING THE GLOBAL MARKETPLACE:

Big content spends, tapping emerging markets, and automated versioning: these are just a few of the strategies OTT companies are turning to in the fight for dominance in the global marketplace. Stay on top of the business trends and learn about the challenges streamers face with these hand-curated articles from the NAB Amplify archives:

- How To Secure the Next Billion+ Subscribers

- Think Globally: SVOD Success Means More Content, Foreign Content and Automated Versioning

- How Does OTT Gain Global Reach? Here’s Where to Start.

- Governments Draw Battlelines To Curb the US Domination of SVOD

- Streaming Content: I Do Not Think You Know What That Word Means

“In 2022, we expect content investment to exceed $230 billion, primarily driven by subscription streaming services, as the battle in the original content arena intensifies — both in the US, but also in the global markets which are increasingly key for growth,” says Hannah Walsh, Research Manager at Ampere Analysis.

After being hit by ad spend cut-backs and production halts during the earlier phases of the COVID pandemic, investments in content by commercial and public service broadcasters rebounded in 2021. Despite this recovery, Ampere found the amount spent on content from these groups remains below 2019 levels, largely due to ongoing pressures on TV advertising revenue. According to the analyst, this is a consequence of a mixture of viewing shifts to online video, and lingering economic effects influencing advertiser expenditure.

However, SVOD services increased investment in content by 20% in 2021, reaching nearly $50 billion. Apple TV+, Disney+, HBO Max, Peacock and Paramount+ invested over $8 billion in original content in 2021.

READ MORE: Content spend sees double digit growth and reaches $220 billion in 2021, driven by SVoD services (Ampere Analysis)

Netflix continues to dominate SVOD content investment. It contributed 30% of all SVOD content spend and 6% of total global content investment in 2021. Netflix is the third largest investor in professional video content at a group level ($14 billion), behind Comcast and its subsidiaries ($22.7 billion), and Disney ($18.6 billion).

ALSO ON NAB AMPLIFY

Walsh explains: “Comcast and Disney invest heavily in sports rights, which — alongside their hefty investments in original content — contributed to their leading positions. Sports rights made up of over a third of both Comcast and Disney’s spend in 2021.”

Discussion

Responses (18)