TL;DR

- Media universe cartographer Evan Shapiro asserts that “disruption is the operating system” of today’s Media & Entertainment industry, urging companies to adapt or risk obsolescence.

- The decline of traditional “triple-play” bundles and the rise of consumer-centric platforms like Disney+ signal a new era in media, one that began in earnest in 2019 and has already surpassed legacy models in global reach.

- Shapiro calls for a seismic shift in business models, advising companies to move “out of the burning house” and embrace new, consumer-focused structures.

- He points to “The New York Times,” which has successfully pivoted to a user-centric model, as an example of how traditional media can thrive through adaptability and consumer engagement.

- Looking ahead, Shapiro emphasizes that understanding and catering to consumer behavior is not just strategic but imperative for survival and growth.

In a Media & Entertainment landscape where change is the only constant, media universe cartographer Evan Shapiro’s insights serve as both a compass and a call to action for industry professionals.

Navigating the complexities of today’s M&E industry requires a keen understanding of its evolving dynamics. From the growing influence of Big Tech to the shift toward consumer-centric business models, the industry is undergoing transformations that are both challenging and exciting.

Shapiro provides a critical roadmap for Media & Entertainment professionals. By embracing a consumer-centric approach and adapting to technological disruptions, M&E companies can not only survive but thrive in this new era.

Disruption Is the New Normal

The term “disruption” has almost become cliché in an era marked by unprecedented change. Yet, Shapiro asserts that “disruption is now the operating system of the media business.” It’s not a single event or even a phase, but a continuous state of being that companies must adapt to in order to survive.

This disruption is fueled in part by the decline of the traditional “triple-play” bundle of broadband, phone, and video. Shapiro identifies this decline as a root cause of what he calls the current media apocalypse.

The industry’s traditional power structures are being upended, making room for new players and paradigms, but incremental changes won’t cut it, and Shapiro emphasizes the need for a seismic shift in business models and strategies. “We have to move out of the burning house and into a new structure,” he warns.

“It’s about recognizing that the old rules no longer apply and that clinging to outdated models is a recipe for obsolescence.”

Adding to the complexity is the outsized impact of tech giants like Apple and Google. “These massive big tech Death Stars and the disproportionate gravity that they have in the ecosystem… enables them to invade the markets of the traditional players in these segments, and take share mindshare revenue share attention share away from the traditional players.”

This isn’t a time for nostalgia, Shapiro says; it’s a time for action. Companies that fail to recognize this new operational reality risk being left behind. Disruption serves as both a challenge and an invitation — to innovate, to disrupt before being disrupted, and to set the stage for the industry’s next act.

Welcome to the Consumer-Centric Era of Media

In the past, the M&E industry operated on a “build it, and they will come” philosophy. Content creators and distributors held the reins, dictating what consumers should watch, read, or listen to. Those days are long gone, says Shapiro.

“We are already in a new user-centric era,” he declares. “We’re not approaching it. It’s not coming. It’s not on its way. It’s here and it’s been here for some time.”

According to Shapiro, our current user-centric era officially began in 2019. “When Disney+ launched, they got 10 million new subs in one month,” he explains. “In less than three years, they passed Netflix for total worldwide subscribers, and in the process bringing everyone else from traditional media along into this brave — or scary — new world.”

This isn’t a passing trend; it’s a fundamental shift in the industry. Consumers have gone from being passive recipients to becoming active participants who curate their own media experiences. “The consumer now curates their own media bundle on their phone,” Shapiro points out.

In this new landscape, traditional metrics like ratings and box office numbers are becoming obsolete. The new gold standard? Consumer engagement. “Companies that super-serve a highly engaged, valuable set of consumers will win,” Shapiro predicts.

The key to thriving in this new era is adaptability. Companies need to pivot from being mere content providers to becoming platforms that offer deeply engaging and personalized experiences. “Think about new ways to generate revenues to keep consumers satisfied, that aren’t necessarily your traditional business model,” he suggests.

Evolving Business Models and Strategies

The M&E industry is at a pivotal juncture, and the old rulebook has been tossed out the window. Gone are the days when traditional methods could carry a company through; today’s landscape demands agility and foresight. “Business models are being reinvented in real time,” Shapiro says.

The New York Times is a prime example of a traditional media company that has successfully transitioned to a user-centric model. “The New York Times doesn’t have 200 million subscribers, yet it’s thriving because it’s super-serving a highly engaged, valuable set of consumers.”

In the early 2010s, The Times found itself in a precarious position and took a bold step by bringing in fresh leadership from outside the US media ecosystem, BBC head Mark Thompson. His arrival marked a sea change for the organization. “He took money out of the print newsroom and put it into the digital newsroom,” Shapiro recounts. The Times diversified its offerings far beyond traditional news, venturing into podcasts, television production for FX, and even becoming a significant player in the game industry.

This shift wasn’t just about reallocating resources; it was a complete transformation. “In 2022, where the rest of digital media was suffering, The New York Times had a surge not just in subscribers, but also in revenues and profits.”

But what does this new structure look like for the broader M&E landscape? Shapiro predicts consolidation and collaboration will become key strategies as companies join forces to offer consumer must-haves.

Charting the Course Ahead

Shapiro’s insights reveal an industry in flux, yet ripe with opportunity. Far from a cautionary tale, media’s official Unofficial Cartographer offers a blueprint for innovation and growth in a landscape that refuses to stand still.

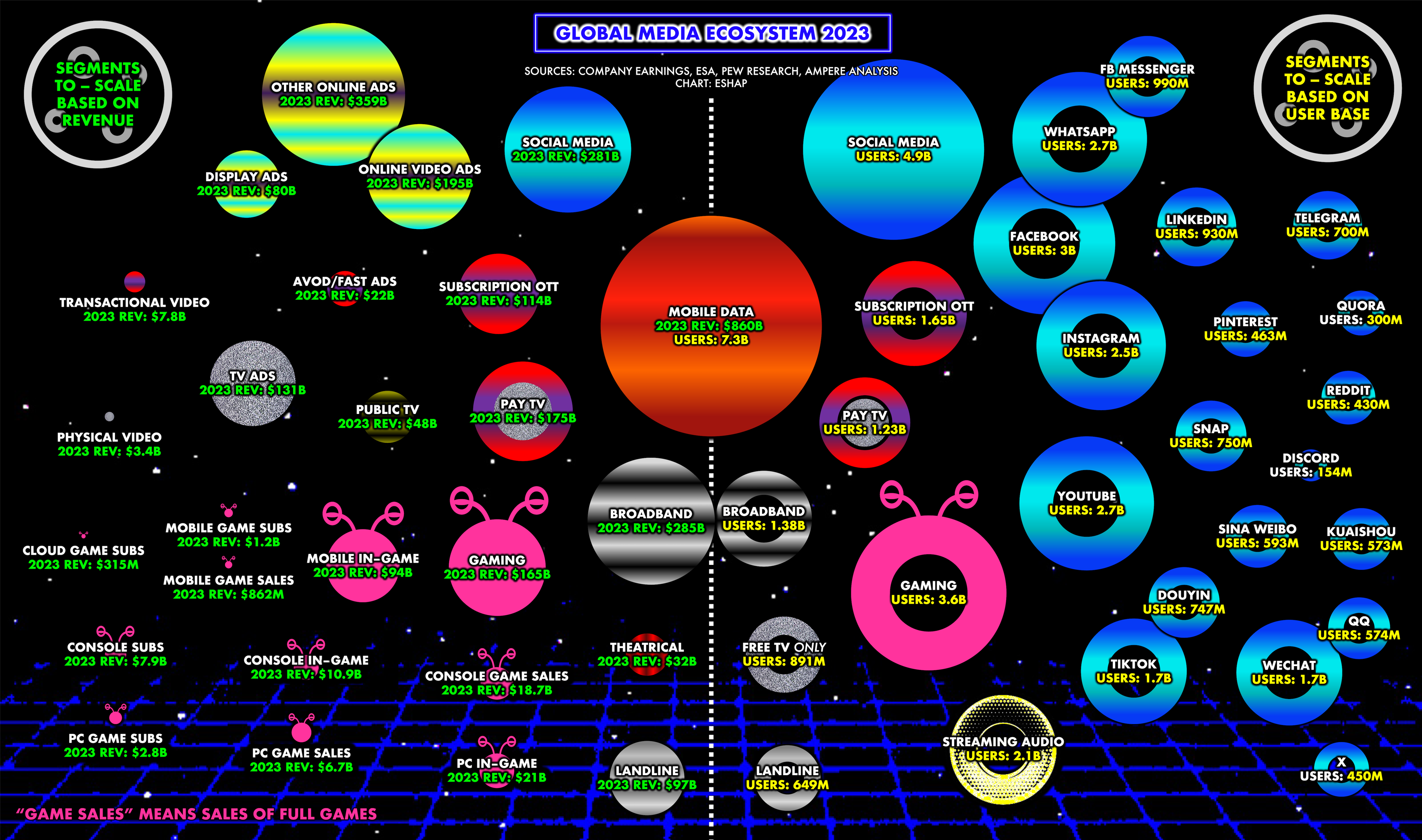

His new map of the 2023 Global Media Ecosystem serves as a navigational tool for understanding these seismic shifts. Scaled by communities and revenue, the map provides a visual guide to changing consumer habits and the choices they face:

“The future of the media business is bright if we let go of outdated practices,” Shapiro exhorts. This means shedding old habits, whether it’s an overreliance on traditional metrics like ratings or an outdated approach to content distribution.

So, what’s the playbook for M&E professionals aiming to not just survive but thrive?

- Embrace Disruption: View upheaval not as a menace but as fertile ground for innovation. Adaptability is now the industry’s most prized asset.

- Prioritize the Consumer: The audience now holds the remote, the mouse, and the touch screen. Recognizing this power shift and adapting your strategies accordingly is no longer optional—it’s imperative.

- Innovate or Perish: Stagnation is the new downfall. The industry has little room for outdated practices; staying ahead means constant innovation.

- Focus on Engagement: In an era awash with content, the depth of consumer interaction is the real barometer of success. Companies that can forge meaningful connections will lead the pack.

The M&E landscape is at a pivotal juncture, and the decisions made now will cast long shadows. Heeding Shapiro’s counsel and taking decisive action can not only steer companies through these choppy waters but also illuminate the path to a more innovative and consumer-centric future. As he puts it, “We can get back to growth, we can get back to relevancy, we can get back to opportunity inside the media ecosystem.”