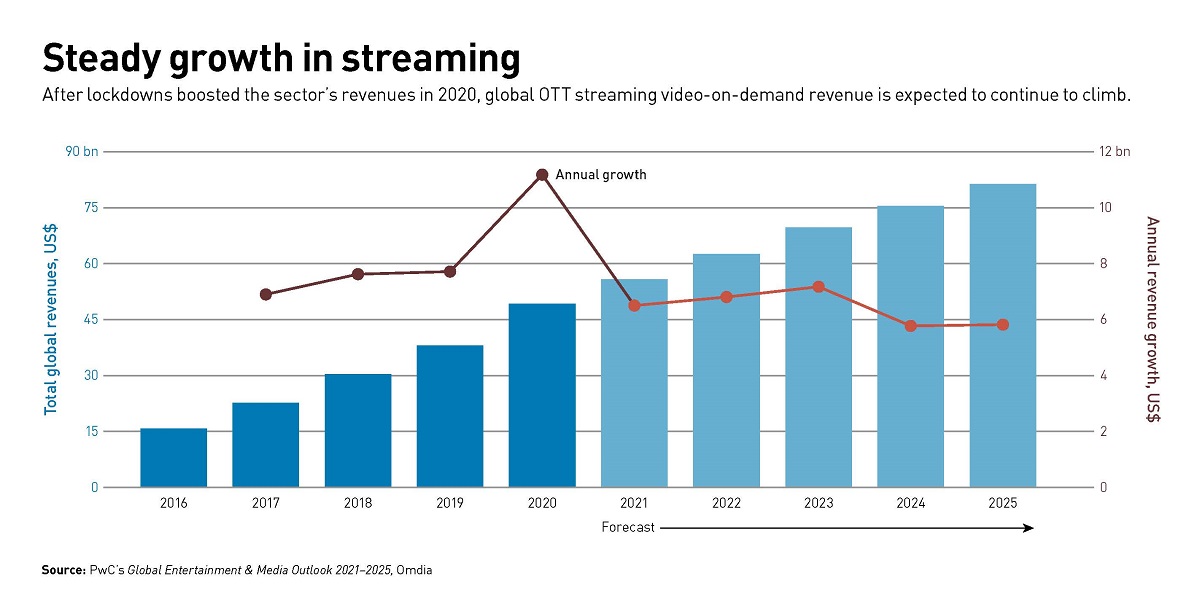

According to PwC’s Global Entertainment & Media Outlook 2021–2025, global OTT revenues rose 26.2% in 2020, reaching $58.4 billion. This streaming boom has set the industry on a trajectory for rapid growth, with revenues expected to reach a whopping $81 billion by 2025.

NAB Amplify sat down with PwC executives Mark Borao, Kim David Greenwood and Kate Kennard to discuss the highlights of the company’s Streaming Energy report, which examines how consumer habits have shifted since the beginning of the COVID-19 pandemic, how these changes could affect the future of SVOD, and the five key journeys for meeting the challenges that lie ahead.

The panel kicked off with a discussion about the boost in revenue the streaming industry experienced following the advent of the COVID-19 pandemic. “Most all of the players in streaming media have been winners during the pandemic,” said Greenwood. “Probably the players who did not benefit from the pandemic the most are the movie theater players.”

Disney, HBO Max and Netflix were the clear winners, Greenwood said, while noting that Netflix actually lost roughly 400,000 subscribers in the US and Canada in one of the few retractions the analysts have seen to date. “Interestingly, Sony also has chosen to play a slightly different role in the industry as a supplier,” Greenwood said. “We’ll see how that strategy pans out long-term.”

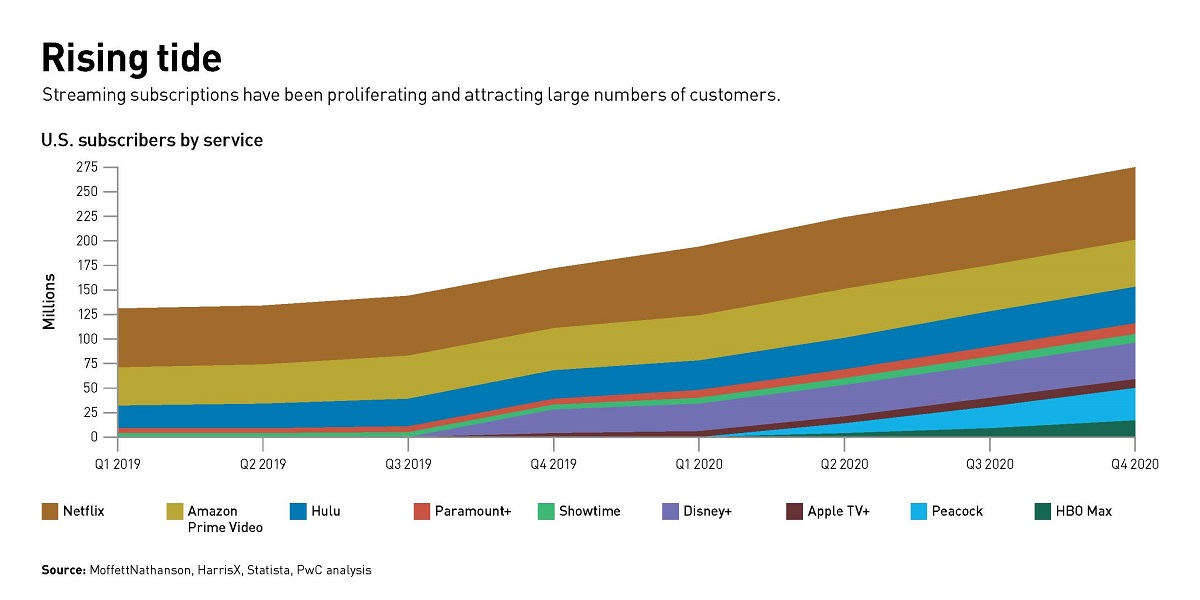

Consumer habits have shifted since the beginning of the pandemic, Borao said, and will continue to evolve. “What our report found was that consumers are watching a lot more OTT platforms and a lot more consumption,” he explained. “So within the US we saw that consumers now subscribe on average to four streaming services versus three last year pre-pandemic, and they’re shelling out 24% more for on-demand streaming services than what they were the year before.

“Viewing hours, which used to be around six hours a week are now near nine hours a week. So I think with the shutdown, with people being spending more time at home, there is this huge uptick in platforms that have launched in content that is launched. And what we’re seeing across the board is consumers are subscribing to more services, and they are in fact, actually consuming more content in their homes than what they were pre-pandemic.”

The next phase of growth for the streaming industry will include consolidation as companies continue to jockey in the race for content.

“Only time will tell, but I think what we expect is more consolidation,” says Borao. “I think the arms race, if you will, around content and spending is just going to continue to increase. We have a lot of public data that’s out there around, everyone upping their content span. And I think we’re going to see a lot more of that, but I think it’s going to look a little bit different across the globe than what it looks like right now.”

PwC’s Streaming Energy report outlines five key journeys for meeting the challenges ahead: Social Discovery, Universe Building, Agile Storytelling, the Quest for Monetization, and Workflow at Scale.

Social Discovery “is about taking elements of social media and combining them with how consumers find and discover content,” Kennard explains. “We know that the number one thing that drives consumers to purchase or try something is actually a recommendation from a friend or family member. So social discovery takes this trend and weaponizes it,” she adds, pointing to Peloton’s practice of posting leaderboards from individual workouts as a key example of the trend.

CHARTING THE GLOBAL MARKETPLACE:

Big content spends, tapping emerging markets, and automated versioning: these are just a few of the strategies OTT companies are turning to in the fight for dominance in the global marketplace. Stay on top of the business trends and learn about the challenges streamers face with these hand-curated articles from the NAB Amplify archives:

- How To Secure the Next Billion+ Subscribers

- Think Globally: SVOD Success Means More Content, Foreign Content and Automated Versioning

- How Does OTT Gain Global Reach? Here’s Where to Start.

- Governments Draw Battlelines To Curb the US Domination of SVOD

- Streaming Content: I Do Not Think You Know What That Word Means

Universe Building refers to the creation of deep environments of storytelling for consumers, such as the Marvel Cinematic Universe and the Harry Potter Franchise. “Universe Building enables companies to deepen their relationships with fans who actually prefer these longer-term multifaceted relationships with the individual brands. So it’s a success for all.”

Agile Storytelling aligns creative output with business objectives, requiring close collaboration between cross-functional teams, including even data scientists. “Streaming companies would do well to take a page from Silicon Valley and actually incorporate the agile methodology into the creative process itself,” Kennard says. This agile approach means that writers will need to develop scripts with the input of business executives. “We think this agile method can be applied, not just to teaming, but in the actual way that stories themselves are told.”

Streaming companies are still experimenting around their monetization models, Greenwood cautions, as the market opens up to include SVOD, AVOD and PVOD. “What we see is existing players migrating their portfolios from their traditional assets to the streaming platforms,” he says, “And right now they’re experimenting with that as well.”

The metric for success will become ARPU, or average revenue per user, Greenwood notes. “It’s really about expanding customer lifetime value to offset the customer acquisition costs,” he says, pointing to Disney as an example. “The most successful companies will be those that are deepening their share of a customer’s wallets and expanding the value of their franchises.”

READ MORE: Our Industry’s on the Rebound… But From a Not-Awesome Reality (NAB Amplify)

Workflow at Scale is the final key journey streaming companies must take to remain competitive. “In many ways, large entertainment companies treated their news streaming services exactly like a startup,” says Kennard, noting that these entertainment giants sought top technology talent and took a digital-first approach that allowed them to avoid being encumbered. “They were able to build them very quickly and they work well,” she says, “And they’ve scaled quite well as the subscribers have continued to roll in.

“Most of the innovation to date has been focused on the distribution side of the business, and where this leads to next is likely on the production side of things,” she continues. “So the industry is looking towards production in the cloud, meaning that all video and assets aren’t going to be ingested straight into the cloud, from the script through to the VFX files and the raw video files, and that will create an easy way to track different media elements and building a universal linking system, which is going to create a lot of ability to automate mundane tasks and ultimately gain even more efficiency.”

As the use of Artificial Intelligence continues to grow, many task will become increasingly automated, says Borao. “We think the workloads, the intelligent automation, the capabilities around content, QC of content, smart content, smart contracts, paves the way for content to find its ultimate distribution path,” he says. “We think we have a very clear line of sight in that we see lots of innovation, both on pre-production, production, post-production, as well as distribution.”

Ultimately, the intense competition for both customers and content should be viewed in a positive light, says Borao. “The good news is consumers are winning. They have lots of choices. Depending on what your appetite is, you’re generally going to find it on a streaming platform.”

Want more insights on what the future might hold for the streaming industry? Watch the video above for NAB Amplify’s exclusive panel discussion with PwC executives Mark Borao, Kim David Greenwood and Kate Kennard.

Discussion

Responses (1)