Watch media universe cartographer Evan Shapiro’s keynote address, “What’s Next” at the 2023 NAB Show New York.

TL;DR

- Evan Shapiro’s keynote address at NAB Show New York continues to dissect the user-centric era of media, focusing on the digital ad revolution and the essential “Rules of Gravity” for the M&E industry to successfully navigate the new landscape.

- The streaming boom has led to a saturated market, and Shapiro highlights the challenges of subscription churn and the need for innovative business models to retain viewer engagement and ad revenue.

- Shapiro’s analysis of industry data reveals a seismic shift in ad revenue, with digital and CTV ad spending projected to reach nearly $58 billion in 2023, challenging traditional TV’s market dominance.

- The advertising paradigm is changing, with a significant portion of ad spend concentrated among a few tech giants and a move towards performance-based digital marketing, emphasizing the importance of ROMI and ROAS in media buying.

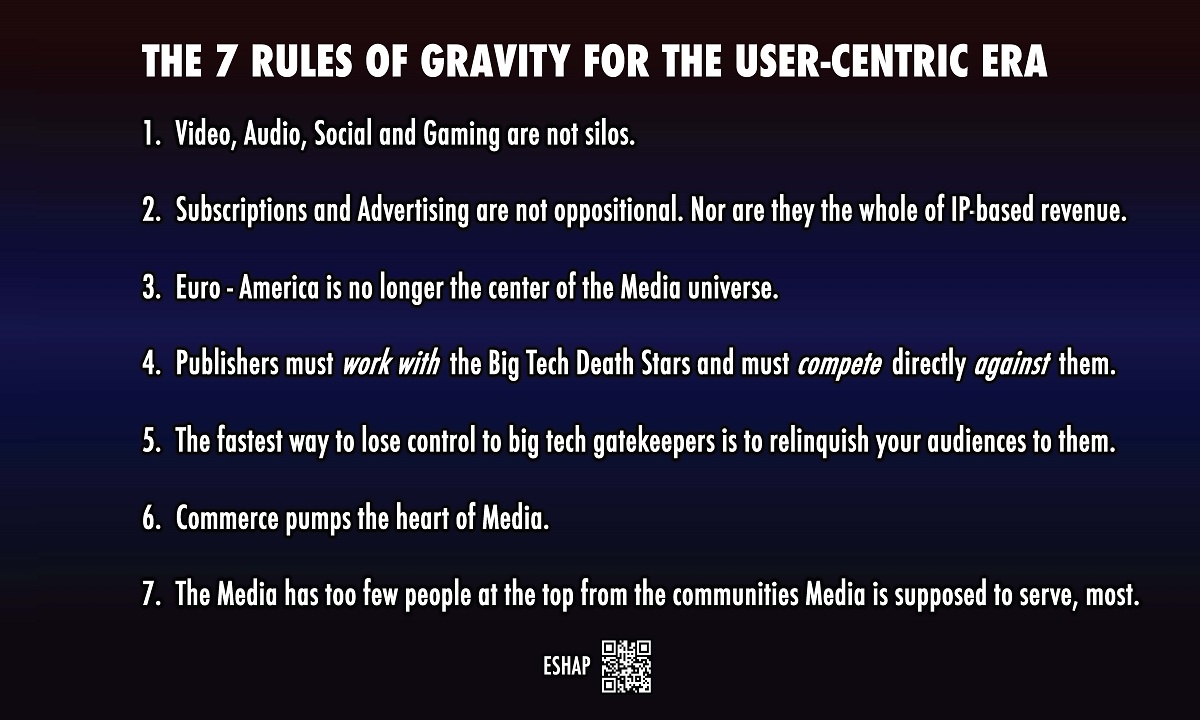

- Shapiro concludes with his “7 Rules of Gravity,” advocating for integration, a symbiotic relationship between subscriptions and advertising, and the strategic importance of daily engagement, commerce, and diversity in leadership to thrive in the user-centric era.

READ MORE: Evan Shapiro Reveals “What’s Next” for Media in the User-Centric Era — Part 1 (NAB Amplify)

Backed by new research and fresh market analysis, media universe cartographer Evan Shapiro’s keynote address at NAB Show New York charts a course for navigating the new user-centric era of media, where seismic shifts are rapidly reshaping the industry and the rate of change is constant.

Part 1 of NAB Amplify’s two-part report examines the profound transformation of the Media & Entertainment landscape, from evolving consumption habits to fulfilling consumers’ “Hierarchy of Feeds” as a strategy for thriving in the new era. Part 2 continues the exploration, delving into the digital ad revolution and the pivotal “Rules of Gravity” that can help companies redefine their business strategies.

Explore the key highlights detailed below, and gain full access to Shapiro’s insights by watching the keynote address in the video at the top of the page.

Streaming Ascendant: Growth and Challenges

The streaming sector is experiencing an unprecedented boom, reshaping the M&E landscape with its rapid growth and the challenges that accompany it. As streaming services proliferate, they face the dual challenge of saturating the market while striving to maintain and grow their subscriber bases.

The pandemic, Shapiro notes, served as a catalyst for an unprecedented surge in connected television (CTV) sales and subscriptions, leading to a scenario where “more people have more intelligent televisions than they’ve ever had in more rooms.” This proliferation of smart TVs has not only changed how consumers engage with content but has also raised the stakes for content providers to develop a comprehensive CTV strategy.

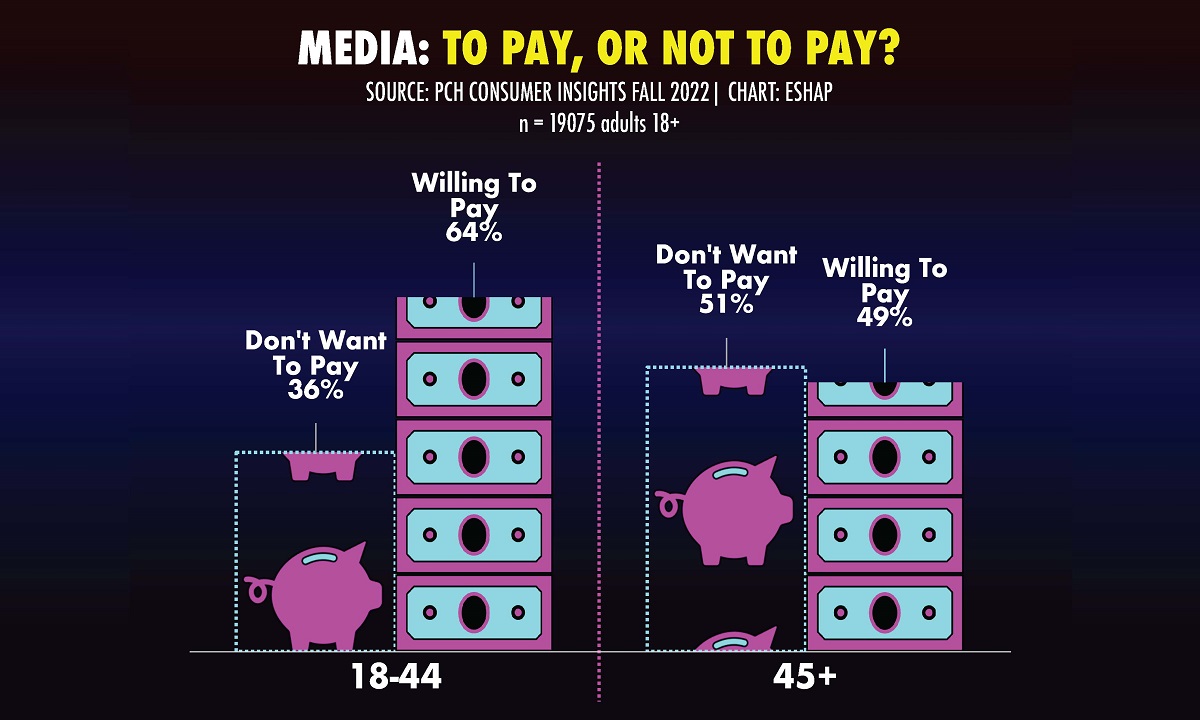

Contrary to the belief that younger audiences are averse to paying for content, Shapiro argues that they are discerning but willing to invest in premium experiences. The decision to pay hinges on content relevancy, the presence of exclusive originals, refresh rates, and the breadth of the content library. These factors are pivotal in attracting and retaining the younger demographic, who place a higher value on content quality and exclusivity than on cost.

Shapiro emphasizes the consumer’s newfound power in the user-centric era, with the ability to fluidly navigate between various content offerings, including ad-supported video on demand (AVOD) and subscription-based video on demand (ASVOD), as well as video game platforms. This shift in consumption patterns demands a cohesive content delivery approach from providers.

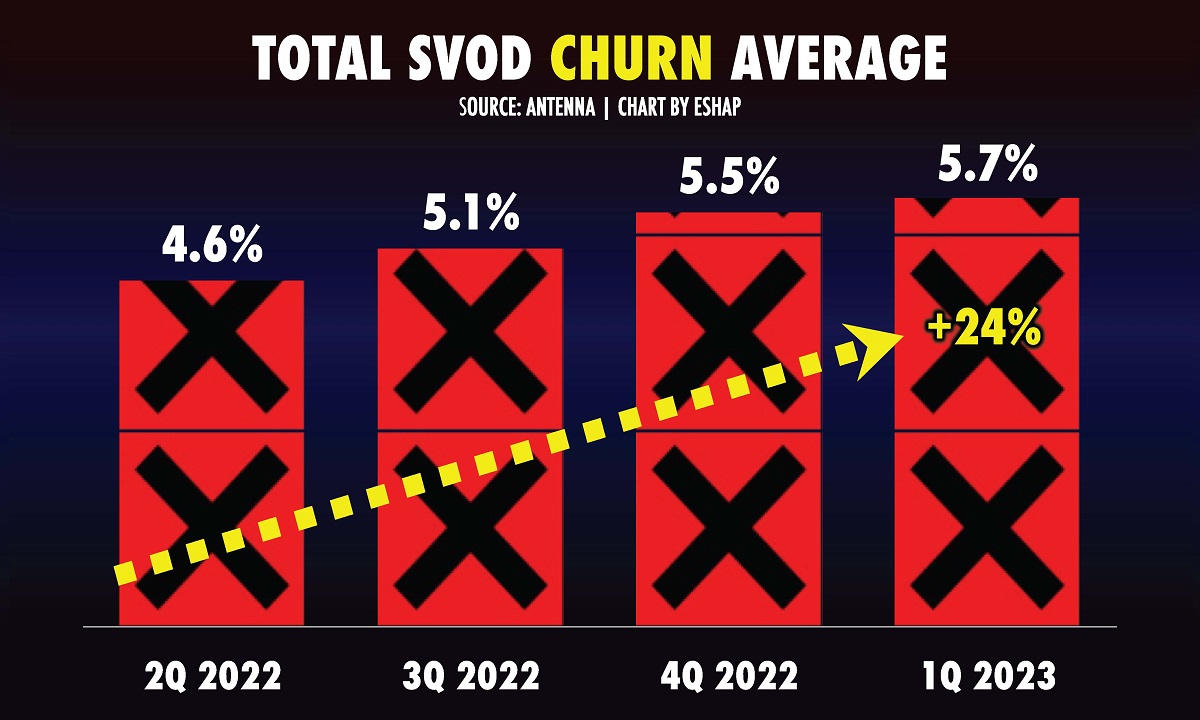

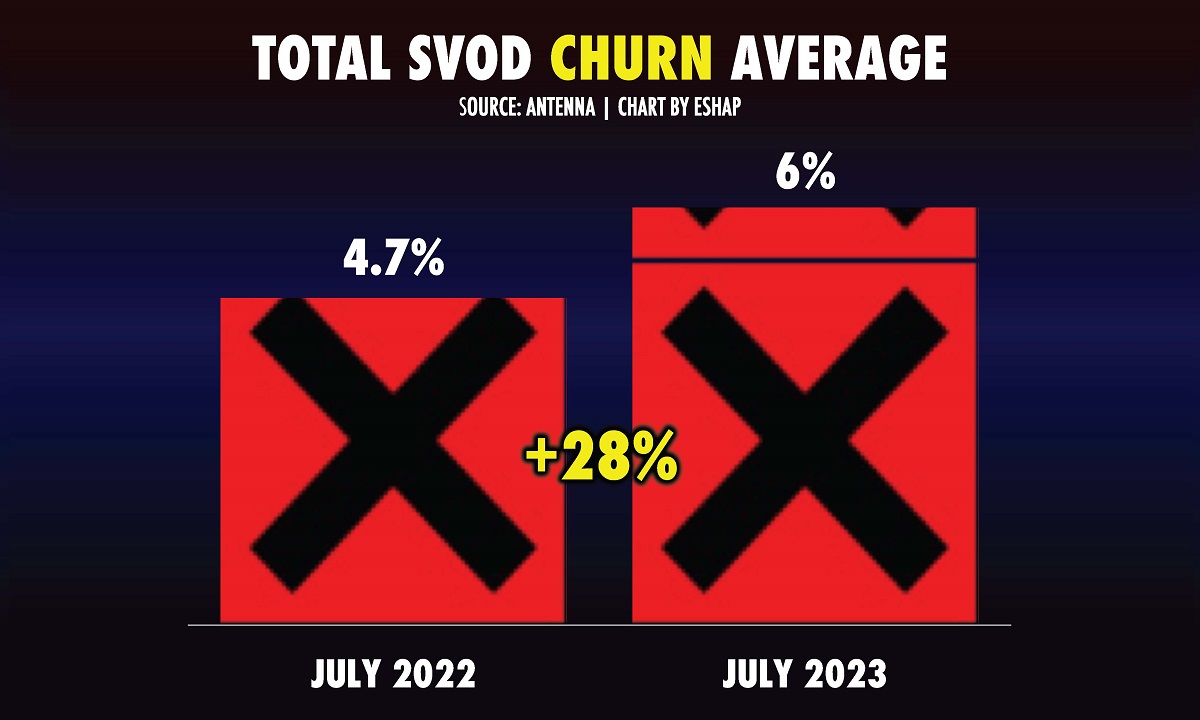

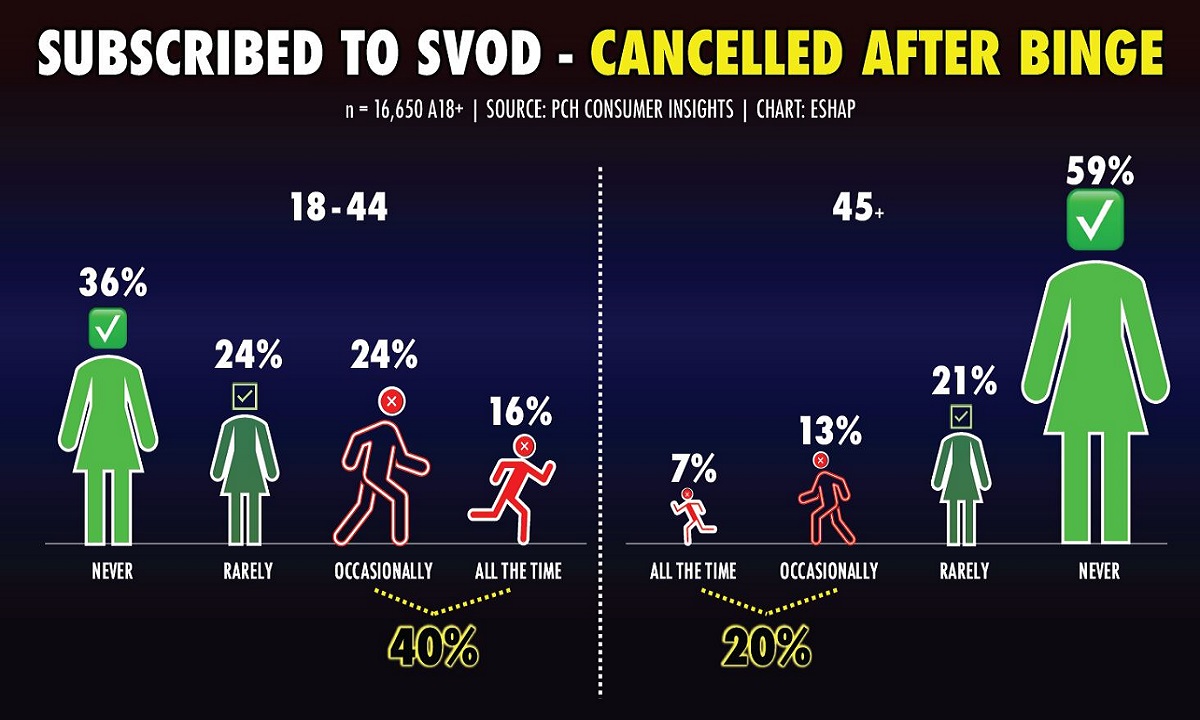

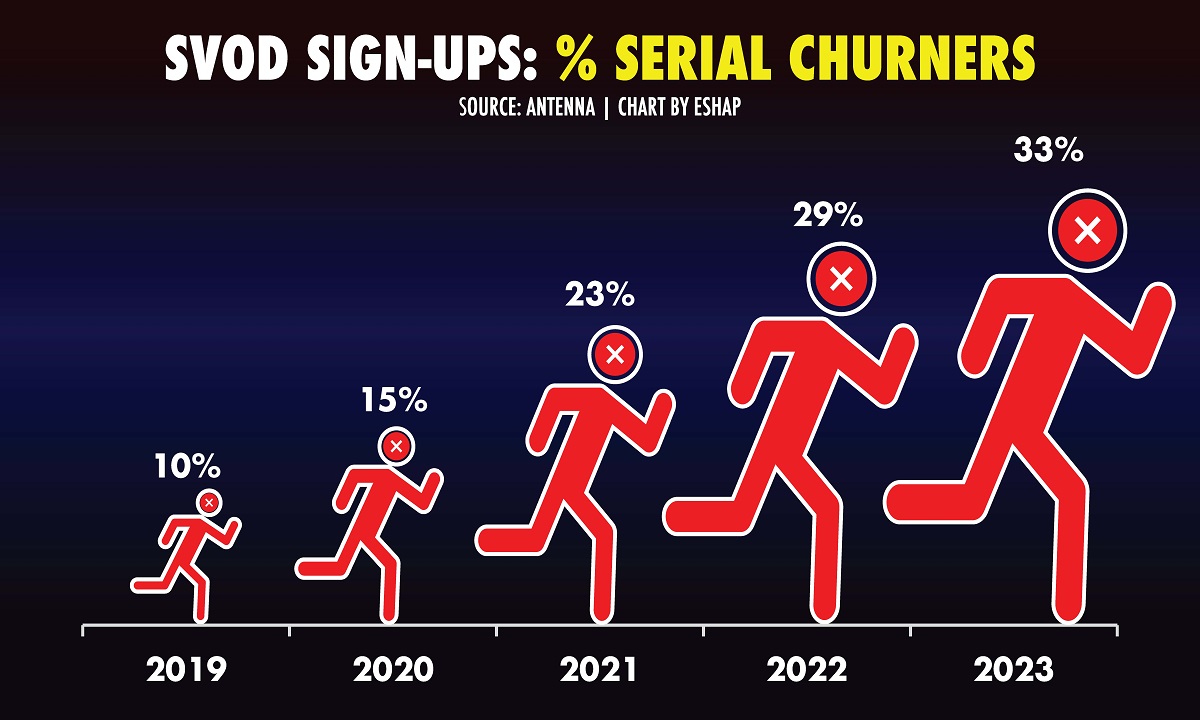

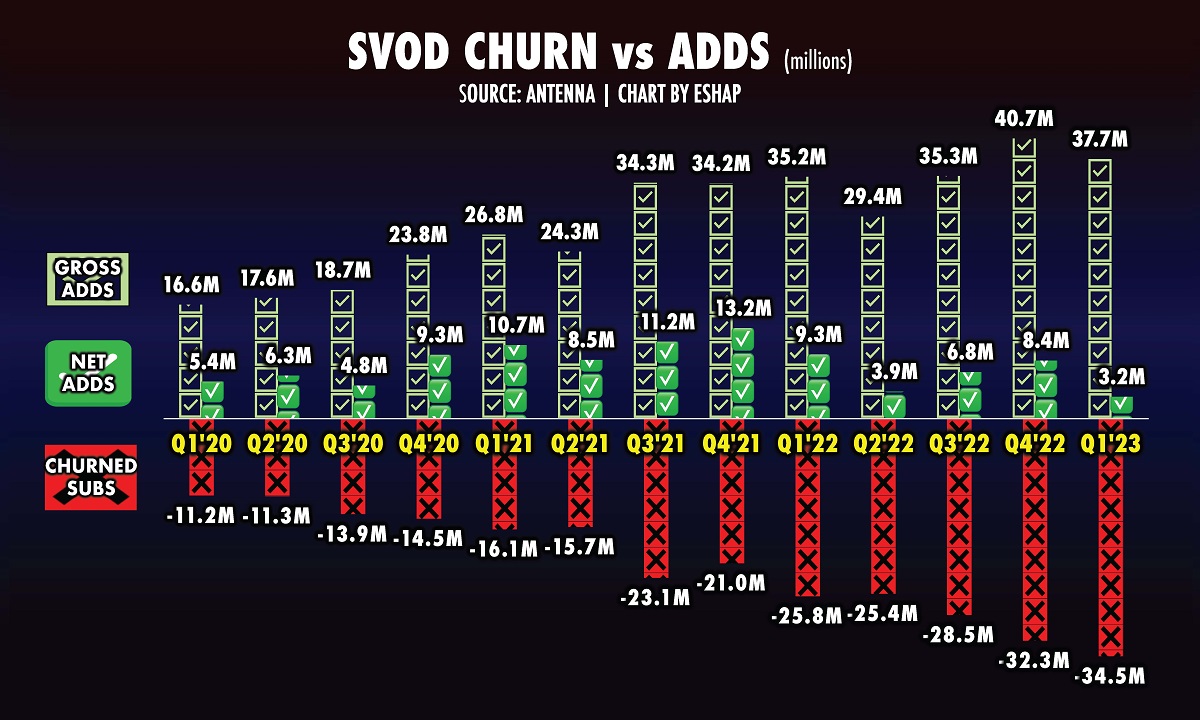

One of the most pressing issues for streaming services is subscription churn. Shapiro sheds light on the industry’s churn rate, which has seen a significant increase. He explains that every four months, a quarter of all premium ASVOD subscriptions are canceled, a trend that reflects the consumers’ growing propensity for “serial churning” — a cycle of subscribing, binge-watching, and canceling.

“If people are churning out on this massive a basis on a regular month-to-month continuum, keeping the ad dollars in ecosystem is going to be difficult in and of itself. It’s not just a subscription problem; it is also an advertising problem.”

The solution, says Shapiro, is to change how streaming companies charge users for content. “They need to figure out ways that are different than just cancel or not cancel,” he counsels. “It doesn’t have to be a binary choice. What if, I don’t know, Pluto and Paramount+ were the same app? And that when you were done with Paramount, you stop paying but you’re still living inside the Paramount ecosystem, and they can still remarket to you? And instead of having to re-onboard the whole time over again, you just click back on for the paid [content]. What if you only pay when you watch, so you always are subscribed, but you’re only paying based on usage?”

Disregarding the need to change their business models will lead to failure, Shapiro admonishes. “Even Netflix is going to have a hard time over the next five years making their business work if they can’t grow their ad business,” he says. “And if they fall into this trap, their ad business will never work.”

Adapt or Perish: The New Metrics of Media Advertising

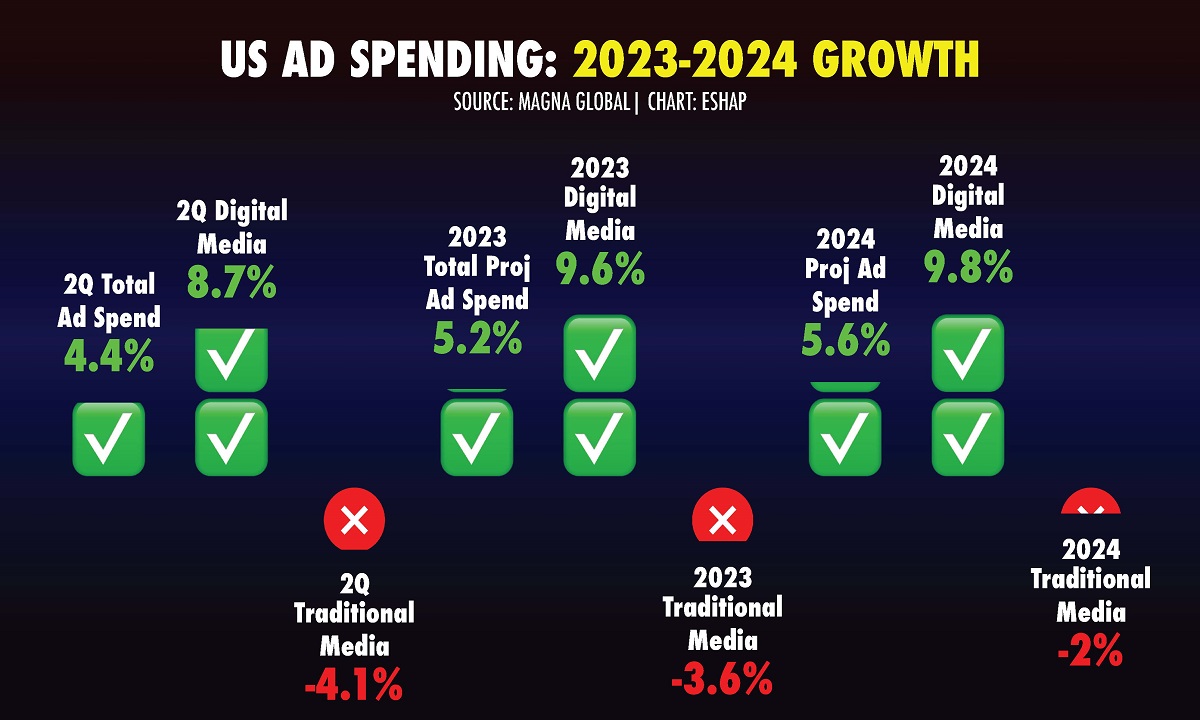

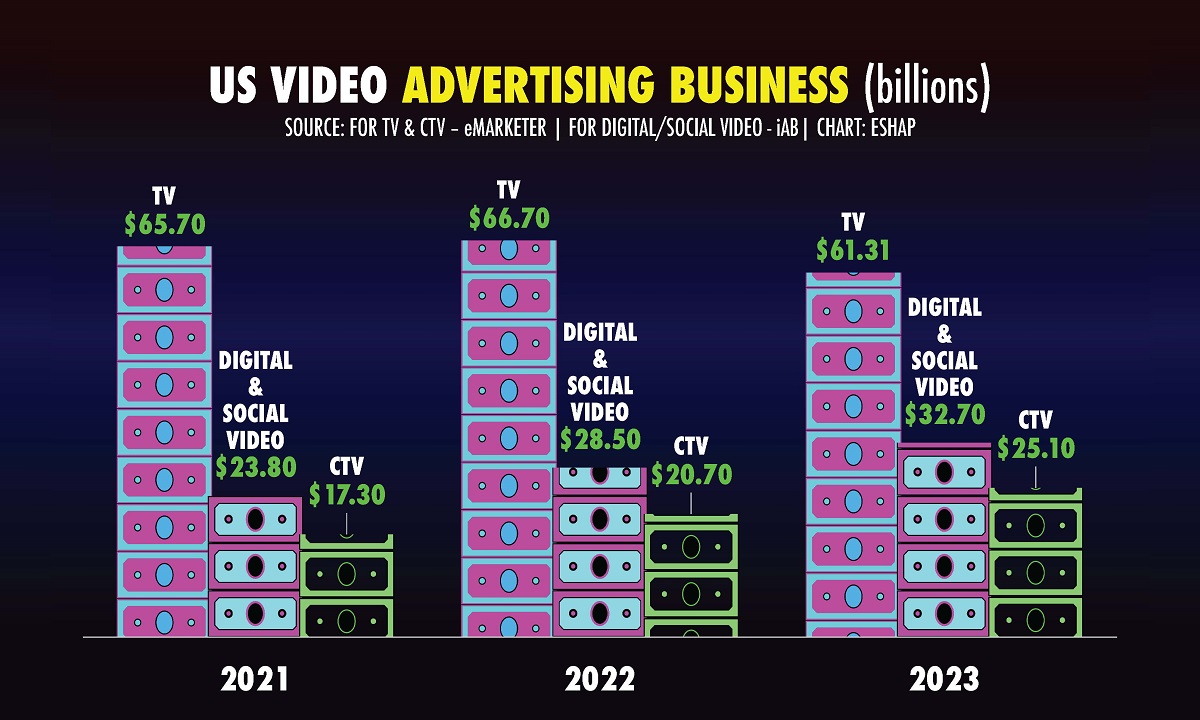

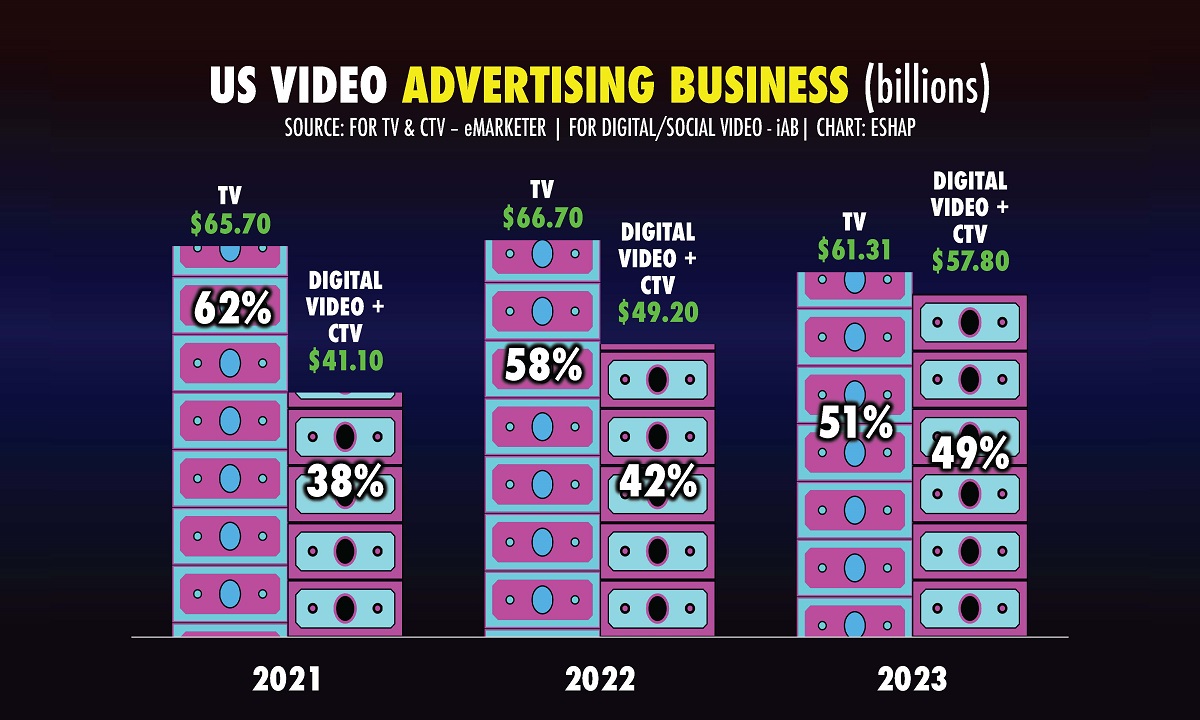

The advertising landscape within the media industry is undergoing a pivotal transformation, with digital platforms and Connected TV (CTV) rapidly ascending as the new titans of ad revenue. Shapiro’s analysis of the latest industry data highlights a critical juncture for media entities: evolve swiftly with new advertising trends or face decline.

“If you’re in the ad business It’s going to be an interesting time,” he says, explaining how the US just exited an 11-month decline in advertising but ad sales, while rising, still haven’t returned to pre-pandemic levels.

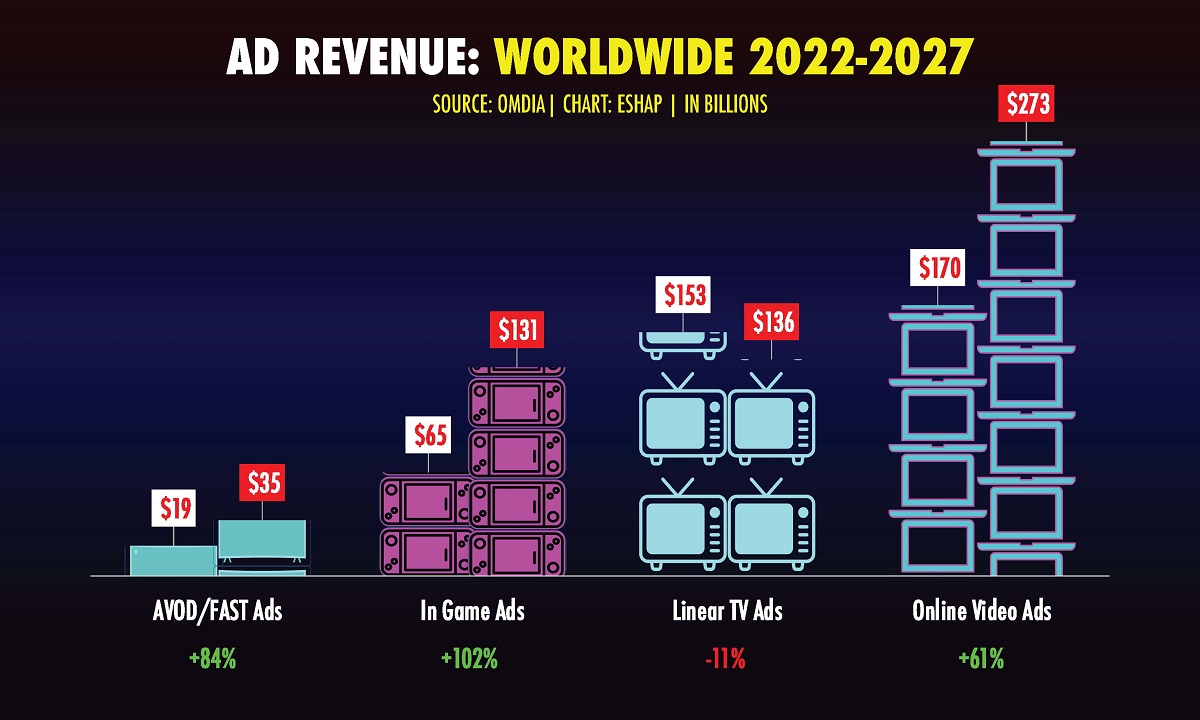

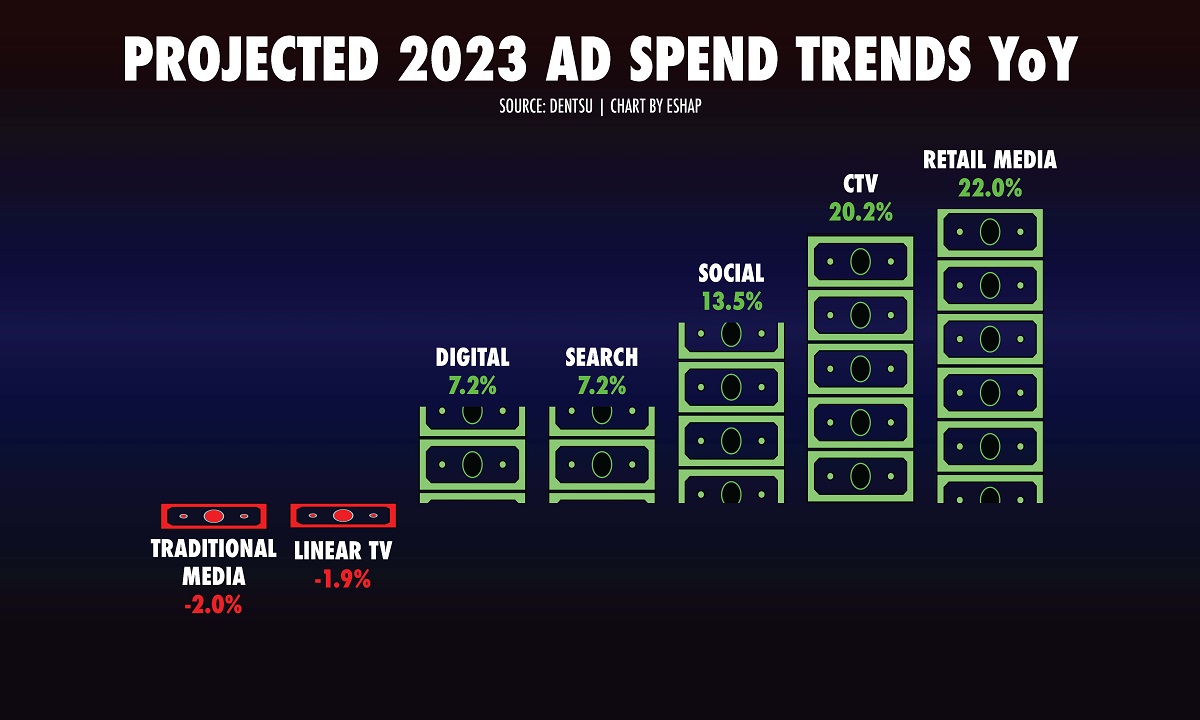

Digital video and connected TV (CTV) platforms commanded an already impressive $41.1 billion in 2021, soaring to nearly $58 billion in 2023. This steep upward trend in digital ad revenue is reshaping the traditional advertising paradigm, Shapiro says. In 2021, traditional TV held a dominant 62% share of the advertising market, but has now contracted to just 51%. In contrast, the market share for digital video and CTV has ballooned from 38% in 2021 to an impressive 49%, signaling a near equalization with traditional TV’s market presence.

Ad spend is indeed on the rise, says Shapiro, pointing to a recent Google earnings call that reported a 12.5% increase in revenue for YouTube, “but it is not being distributed proportionally across the ecosystem the way it was pre-lockdown,” he cautions, “and it never will be again. It’s going to the big platforms. And it’s going to the places where the ad buyers know that their dollars work.”

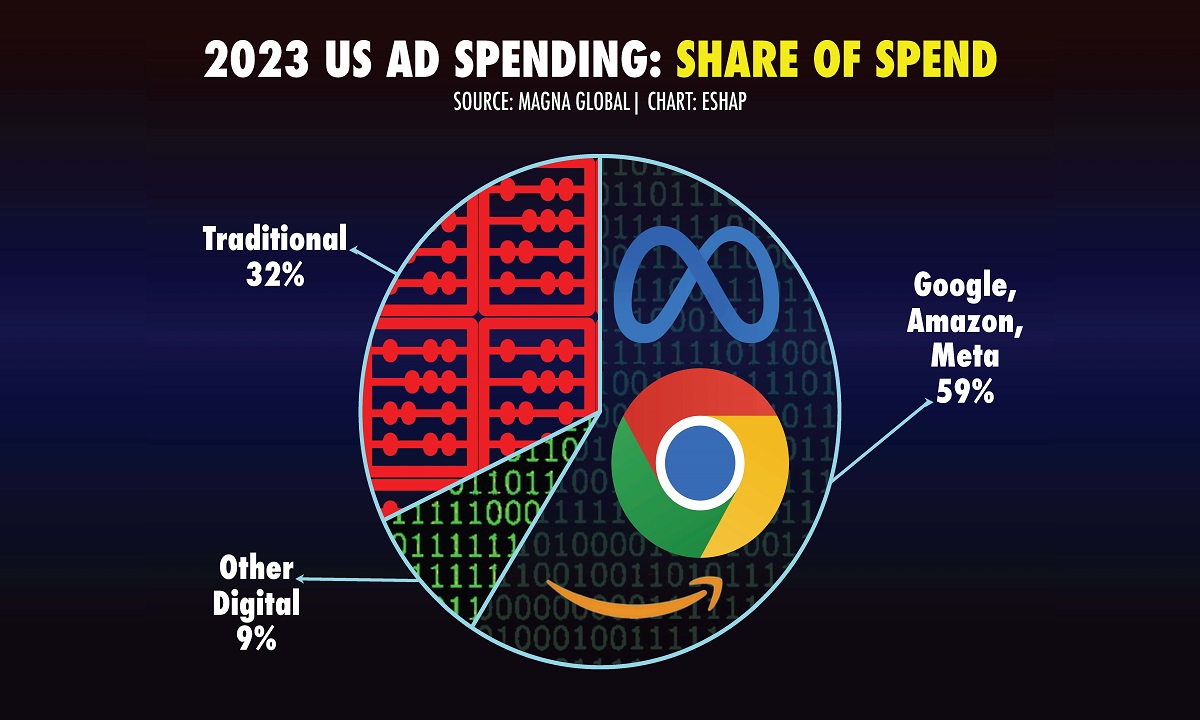

Media buyers, he says, are moving out of more traditional upfront deals “into much more performance-based digital marketing” like CTV and digital. Emphasizing that “the money is going to go where the money works,” he points out that a staggering 60% of all ad spend in the United States is funneled to just three companies.

One crucial point, Shapiro adds, is that consumers see creator-led social video as a quality equivalent to professionally-produced content. “More importantly, for your business, advertisers now see it the same way,” he says, easily moving ad budgets back and forth between these two ecosystems on a regular basis based on pricing performance and need case.

“As a provider of ad impressions [you] need to be able to demonstrate that their money isn’t being wasted when they spend it with you,” Shapiro advises, noting that more than half of advertisers, brands and agencies surveyed said return on media investment is the number one metric for determining media buys.

The key to thriving in this new advertising economy, Shapiro says, is understanding and leveraging the metrics that matter. Return on media investment (ROMI) and return on ad spend (ROAS) are becoming the primary metrics for media buying, he asserts. “This number is going to rise [at] every upfront forever, it’s never going to turn back around.”

Shapiro’s “7 Rules of Gravity for the User-Centric Era”

Shapiro concludes his keynote with the “7 Rules of Gravity” for the user-centric era, guiding principles for media entities navigating the new landscape where consumers dictate the orbit.

Rule 1: Integration Over Isolation — Shapiro champions a unified media experience, where users control the convergence of video, audio, social, and games. “The user is the center of all of it,” he insists, advocating for a seamless integration of media services.

Rule 2: Subscription and Advertising Symbiosis — The second rule dismantles the notion that subscriptions and advertising are at odds. Shapiro argues for a complementary relationship where both models can coexist and bolster the other, providing a stable revenue mix.

Rule 3: Global Audience, Local Content — Shapiro highlights the importance of content that resonates locally while reaching globally, especially for the under-40 demographic that constitutes a majority worldwide.

Rule 4: Compete and Cooperate with Tech Giants — Media companies must navigate the delicate balance of both working with and competing against the tech behemoths. Shapiro advises learning from diversified companies like Amazon and Google, which offer bundled services for consumers and advertisers alike.

Rule 5: Daily Engagement is Must-Have — To be indispensable, Shapiro says, media must engage users daily. “Just because they use you today doesn’t mean you’re a must-have,” he cautions, pushing for consistent and compelling daily engagement.

Rule 6: Commerce Pumps the Heart of Media — Shapiro reminds us that commerce is the lifeblood of media, and integrating commerce into media strategies is not just an option but a necessity. “Commerce pumps the heart of media, it always has,” he states.

Rule 7: Representation at the Helm — Shapiro calls for diversity in media leadership, ensuring content reflects and resonates with a broad audience. “The media has too few people at the top from the communities it’s supposed to serve most,” he points out, stressing that a diverse array of voices in leadership positions is not just a moral imperative but a strategic one.

Shapiro’s parting message is one of urgency and action. He implores media companies to align with these principles swiftly, not only to survive but to lead in the user-centric era. The future favors those who place the user at the core of their strategy, who innovate in content, engagement, and commerce, and who act decisively. The era of user-centric media is not on the horizon — it’s here, and the time to adapt is now.